Travelex Wire vs Paysera: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-20 14:11:32.0 13

Introduction

Cross-border money transfers are essential for individuals and businesses, but challenges such as high fees, slow delivery, hidden charges, and complicated processes often arise. Comparing Travelex Wire and Paysera can help users choose the most suitable service. Both platforms are reliable, but alternatives like Panda Remit provide competitive rates and fast online transfers. For more guidance on international money transfers, see this Investopedia guide on money transfers.

Travelex Wire vs Paysera – Overview

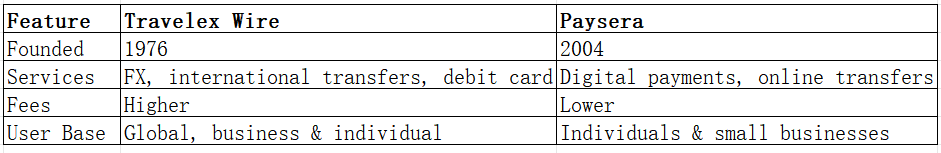

Travelex Wire, founded in 1976, offers international transfers, currency exchange, and debit card services for global users.

Paysera, launched in 2004, focuses on digital payments and international transfers with a mobile-first approach, catering primarily to individual users and small businesses.

Similarities:

-

International money transfers

-

Mobile app availability

-

Integration with bank accounts and debit cards

Differences:

-

Fees: Travelex Wire tends to have higher fees; Paysera offers lower-cost options.

-

Target audience: Travelex Wire serves businesses and travelers; Paysera targets individual users and small businesses.

-

Functionality: Travelex Wire provides broad financial services; Paysera emphasizes digital transfers and convenience.

Panda Remit is another reliable option for fast and cost-effective transfers.

Travelex Wire vs Paysera: Fees and Costs

Travelex Wire applies transfer fees and exchange rate margins, which may make small transfers expensive. Paysera offers lower fees, transparent pricing, and competitive rates for personal and business users.

Fee structures can vary depending on payment method or account type. For more detailed comparisons, see this NerdWallet fee guide.

Panda Remit serves as a cost-effective alternative for standard international transfers.

Travelex Wire vs Paysera: Exchange Rates

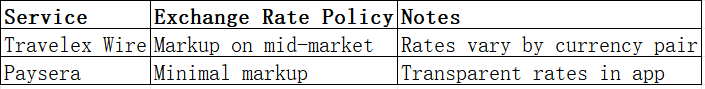

Exchange rates significantly affect the amount received. Travelex Wire generally applies a markup on mid-market rates, while Paysera offers rates closer to mid-market with smaller markups.

Panda Remit also provides competitive exchange rates for users seeking better value.

Travelex Wire vs Paysera: Speed and Convenience

Paysera typically delivers faster transfers due to its digital-first infrastructure, while Travelex Wire may take longer because of verification processes.

Both services support bank account transfers, but Paysera offers a mobile-friendly interface and simpler setup. Travelex Wire provides more comprehensive features but with added complexity.

For more information on transfer speed, see this WorldRemit speed guide.

Panda Remit is a fast alternative with fully online processing.

Travelex Wire vs Paysera: Safety and Security

Both Travelex Wire and Paysera comply with financial regulations, employ encryption, and offer fraud protection. Travelex Wire benefits from its long-standing reputation, while Paysera leverages modern app-based security.

Panda Remit is similarly licensed and secure.

Travelex Wire vs Paysera: Global Coverage

Travelex Wire supports transfers to numerous countries and currencies, suitable for business and personal needs. Paysera focuses on key international corridors outside Africa and provides flexible payout methods.

For global coverage information, refer to the World Bank remittance report.

Travelex Wire vs Paysera: Which One is Better?

Choosing between Travelex Wire and Paysera depends on priorities. Travelex Wire excels in reliability, comprehensive services, and broad coverage but comes with higher costs. Paysera is better suited for users seeking speed, simplicity, and affordability.

For users prioritizing fast, flexible, and cost-effective transfers, Panda Remit may provide the best value.

Conclusion

Travelex Wire vs Paysera highlights the trade-offs between traditional and digital-first remittance services. Travelex Wire provides comprehensive financial services and global reach, while Paysera focuses on speed, convenience, and lower fees.

Panda Remit offers advantages including:

-

Competitive exchange rates and low fees

-

Flexible payment methods (POLi, PayID, bank transfers, e-transfers)

-

Support for 40+ currencies

-

Fast, fully online transfers

For more guidance, see Investopedia’s guide or visit Panda Remit’s official site for an alternative solution.